- Process

- Downloading offline tool from the Commercial Tax portal http://comtax.up.nic.in

- Filling the details in the offline PDF tool

- Submitting the application online and getting the Acknowledgement ID

- Uploading the self attested scanned copy of the relevant documents with Acknowledgement ID and Firm PAN no.

- After successful submission of the application TIN is granted on the same day in case of Non sensitive goods and sent at the e mail ID and mobile no. given by the dealer in the registration form.

- Survey of the business premises will be done after Granting the TIN.

- In case of sensitive goods TIN will be granted after survey.

- Registration certificate will be sent through registered post at the dealer’s principal place of business.

- Pre requisites for E-Registration

- Adobe reader version 11.0 and above

- Internet connectivity

- Scanner

- PDF creator

Instructions regarding filling of the registration application form-VII

- Form-VII is to be filled in Capital Letters only.

- Read the provisions of section-17 & 18 of the Uttar Pradesh Value Added Tax Ordinance, 2007 and Rule 32, 33, 34, 35, 36 & 37 of Uttar Pradesh Value Added Tax Rules, 2008.

- For the proof of identity verification certified copies of any two of the following shall be annexed with the application

- Electoral Identity Card issued by Election Commission of India

- Permanent Account Number [PAN] issued by Income Tax Department, Government of India

- Passport

- Bank Passbook

- For the proof of verification of the residential address certified copies of any two of the following shall be annexed with the application

- In case of own premises certified copy of registered sale deed or in case of rented premises certified copy of lease deed.

- Copy of electricity bill issued by UPPCL of the premises.

- Certificate issued by Tehsildar.

- For the proof of verification of the business place or branch or depot or workshop, certified copies of any two of the following shall be annexed with the application

- In case of own premises certified copy of registered sale deed, in case of rented premises copy of lease deed.

- Certificate issued by Tehsildar.

- Certificate issued by UPSIDC or DIC as the case may be.

- Meter sealing certificate issued by the UPPCL.

- Documents related to the constitution of the dealer other than the proprietor

- Registered partnership deed in case of firm.

- Document by which HUF has been created, in case of HUF.

- Memorandum of association & article of association in case of company or corporation.

- Bylaws of society, club or trust in case of society, club or trust.

- General power of attorney in case of business in the name of minor or in case of incapacitated person.

- Certificate issued by Head of the Department or Office in case of Department of State or Central Government.

- Declaration of trust, in case of trust.

- Certified copy of registration certificate issued under other Act if applicable.

- Shop or commercial establishment Act

- Mandi Act

- Registrar of firms and Society Act

- Service Tax Act

- Industry Department Act

- Central Excise Act

- Drugs & Cosmetics Act

- Registrar of Companies Act

- Registration with KVIC or KVIB

- Any other Act

- Original copy of challan of registration fees or late fee, if any, shall be annexed as a proof of deposit of fee.

- Applicant must be introduced by a registered dealer who is registered for not less than three years with the Commercial Tax / Trade Tax Department.

- There are several penalties for making false declaration and giving wrong information. Therefore the applicants are advised to give correct information only. Dealers are advised to go through the penal provisions provided under section- 54 of The Uttar Pradesh Value Added Tax Ordinance, 2007

- Refund of excess input tax credit or any other kind of refund shall be made through account payee cheque issued by the Treasury Officer of the District; therefore the applicants are advised to give the correct account number and address of the bank / branch in which refund is to be credited.

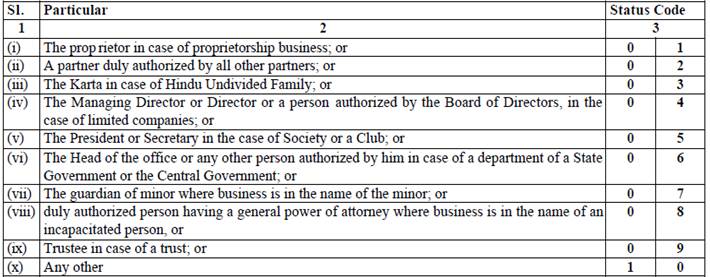

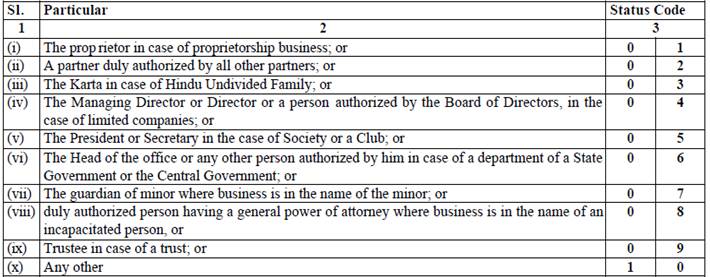

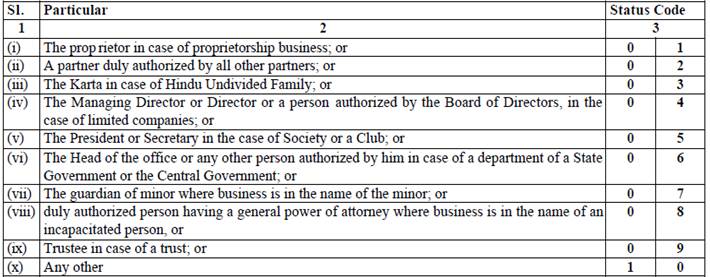

- Application should be signed by the authorized person as provided under rule-32(6) which are described in column-2 and their status code in column-3. Please write the status code in serial no.5 of the application.

- Registration application should be submitted before the registering authority within 30 days from the date the dealer becomes liable to tax.

- Late fee is Rs. 100/- per month or part thereof.

- Tax invoice is the primary proof for claiming the Input Tax Credit and this tax invoice is to be authenticated by the person mention in the annexure-B. Since it involves tax impact on the dealers, therefore the dealers are advised to authorize genuine persons related to business.

- If annexure-B is not submitted as provided in the columns, the applicant is the only person who can authenticate the tax invoice and other document.

- Registration certificate issued under U.P. Value Added Tax Ordinance, 2007 and rules made thereunder will be effective from the date of application. Therefore, the dealers are advised to submit the application complete in all respect along with the annexures provided

- Photograph and signature of the partner, proprietor, Karta of HUF, director authorized by board of directors in case of company, trustee in case of trust mentioned in annexure-A must be attached.

- Attested signature of signatory authorized by the dealer to authenticate the tax invoice and other documents must be marked in annexure-B.

- List of the documents must be attached along with the registration application as mentioned in annexure-E.

- Registration application shall not be accepted by Registering Authority if all information except at serial no. 7, 8, 9, 10, 11 and 25 are not completely filled.

- Application may be rejected on furnishing wrong information. Therefore dealers are advised to give the correct and complete information.

- The application may be rejected if the dealer found to be defaulter under UPTT Act, CST Act, UPVAT Ordinance and UP Entry of Goods Act.

- Only those Codes for Commodities are to be filled in column-17 which is prescribed by the Commissioner.

- Annexure-D is to be filled in case of partnership concerns only.

- Attestations of signature in this form will mutatis mutandis carry the same meaning as in Section-3 of the Transfer of Property Act.