|

|

||||||

|

|

|

|||||

|

|

|

GST System Project: User Manual: GST Practitioner |

||||

|

|

|

Goods and Services Tax Network |

||||

|

5/30/2017

|

||||||

|

|

|

|

||||

Confidentiality Agreement

“This document contains proprietary information exclusively vests with GSTN. This document may not, in whole or in part, be copied, photocopied, stored, saved, reproduced, replicated, disseminated, translated, transmitted or reduced to in any medium (whether electronic, mechanical, machine-readable and/or any other tangible or intangible form of any nature), by the intended recipient/s or user/s without the express consent, in writing, from the Authorized Representative of GSTN Management.”

All the Intellectual Property Rights (i.e. copyrights) as may be available under the applicable laws, pertaining to GSTN’s confidential information, shall exclusively vest with GSTN only, and any breach thereof shall be subject to indemnification

Revision History

|

Version |

Date |

Author |

Reviewer |

Approver |

Comments |

|

0.01 |

31/05/2017 |

Tanmay Sahay |

Snigdha Tayal |

|

Initial Draft |

|

1.0 |

5/30/2017 |

Tanmay Sahay |

Khushboo Jain |

Snigdha Tayal |

Delivered to GSTN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

1.3 Intended Audience for this document

2.1 Applying for Enrolment on the GST Portal as a GST Practitioner

3. Collaborations and dependencies

4. Assumptions and constraints

1. Introduction

1.1 Scope of the document

This document covers the User Manual for when a GST Practitioner files an application for Enrolment as a GST Practitioner under the provisions of GST Act.

1.2 Purpose of the document

This document will be hosted on the Help section of the GST System Portal, in HTML format. The document will help the users of the GST System Portal to understand and easily use the GST System Portal.

1.3 Intended Audience for this document

This document is intended for use by the GST Services team for validation of content and for Infosys Training team to design HTML based user manual.

2. GST Practitioner

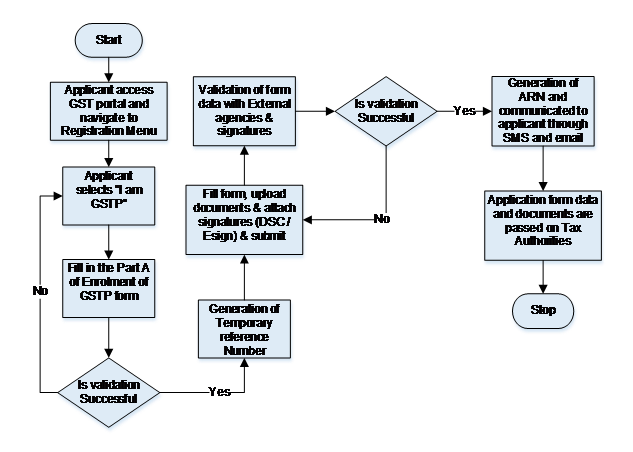

2.1 Applying for Enrolment on the GST Portal as a GST Practitioner

How do I apply for enrolment as a GST Practitioner?

What are the steps involved in applying for Registration as a GST Practitioner (GSTP) on the GST Portal?

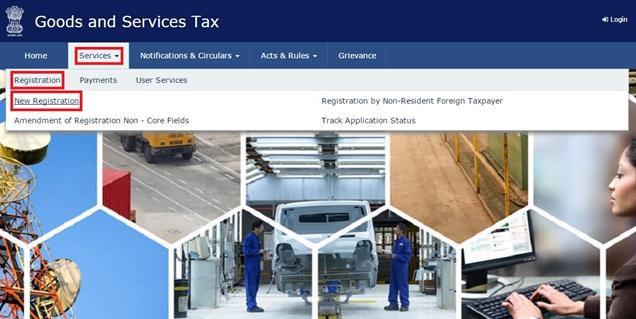

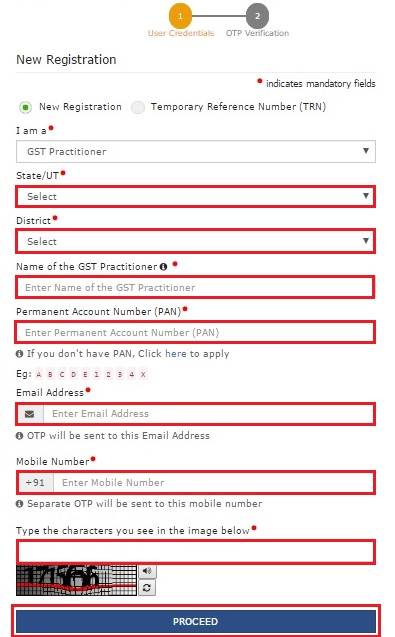

1. Access the GST common portal www.gst.gov.in and select ‘New Registration’ on the landing page of GST Portal. This form is available as pre-login feature.

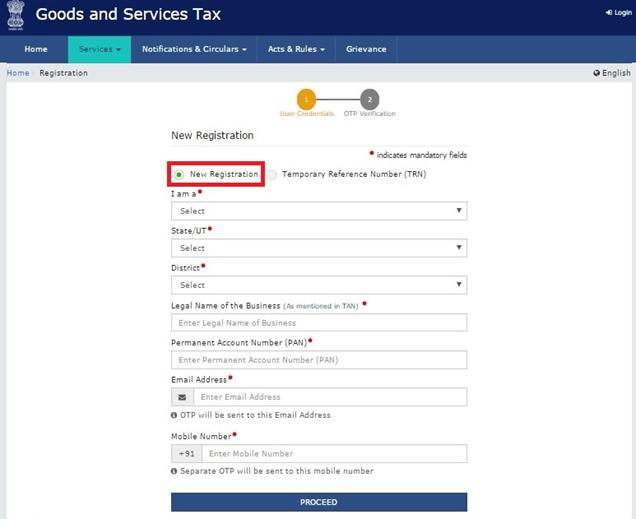

2. Select the Radio Button New Registration.

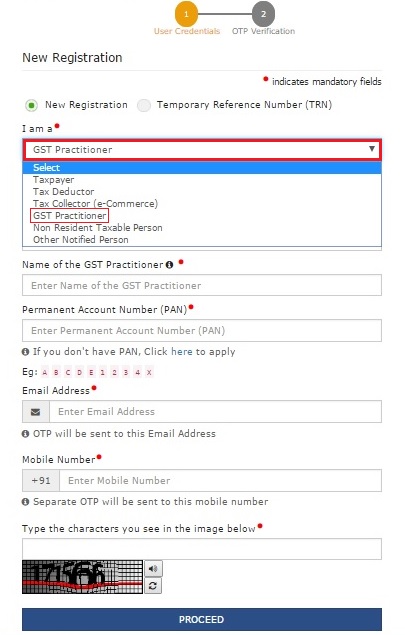

3. Select I am ‘GST Practitioner from the dropdown menu.

4. Fill in the details in all the fields in PART-A of the form as per the screenshot. Please note, your Name and PAN will be validated against the CBDT database. Once you have filled in all the details, enter the Captcha Code and click the PROCEED button.

5. After successful validation, you will be directed to the next page where you will be required to enter a Mobile OTP and an E-mail OPT. The OTPs will be sent to the mobile number and e-mail ID entered in PART-A of the form. Enter the OTPs and click PROCEED.

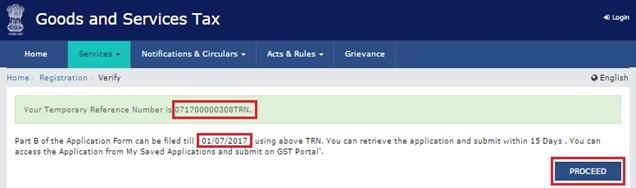

6. You will be issued a 15-digit Transaction Reference Number (TRN). It will be sent to you via e-mail and SMS and below the TRN the expiry date of the TRN will also be mentioned, do take note of that. Click PROCEED.

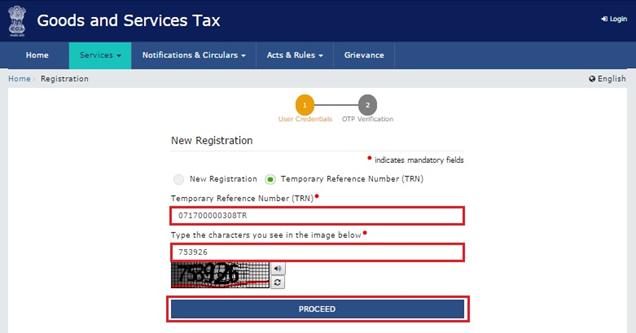

7. After clicking PROCEED, the system will send you an OTP on your e-mail and mobile and you will be directed to a fresh page where you will enter the OTP, enter the Captcha Code, and click PROCEED.

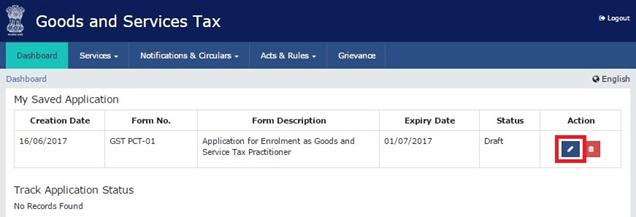

8. After clicking PROCEED, you will be directed to the My Saved Application page from where you can access PART-B of the Registration Application for GST Practitioner. Click on the EDIT icon to access the form.

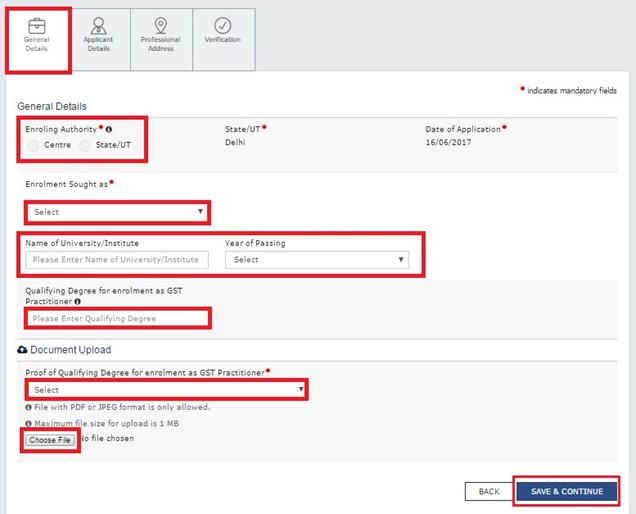

9. PART-B of the form has four sections that must be filled sequentially. The first section is General Details. Enter all the details and click SAVE AND CONTINUE at the bottom of the screen. 9Under enrolment sought as, please select an option from the dropdown given.

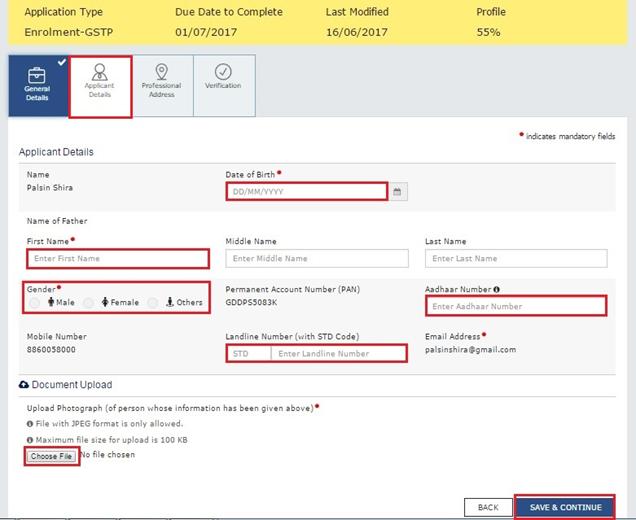

10. The second section is Applicant Details. Enter all the details and upload your photograph. Ensure that your photograph is in JPEG format and the file size is less than 100 KB. No click SAVE AND CONTINUE at the bottom of the screen.

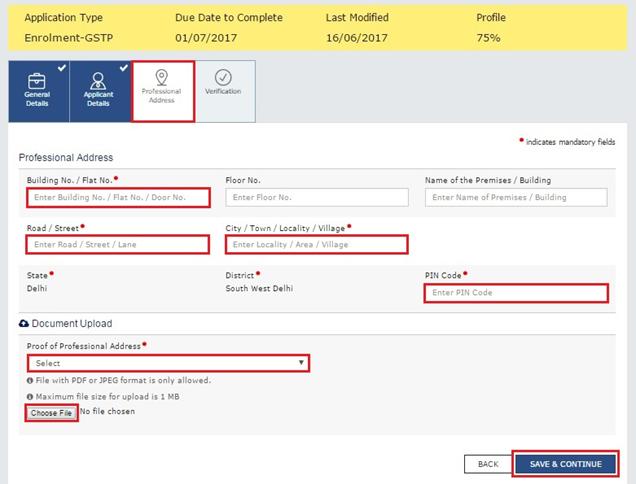

11. The third section is Professional Address. Enter all the details and click SAVE AND CONTINUE at the bottom of the screen.

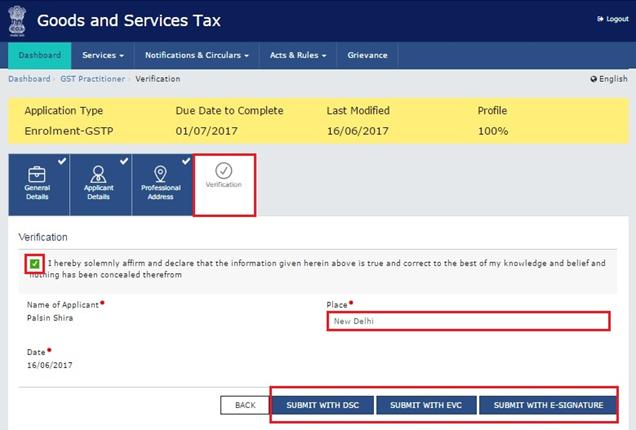

12. The fourth and last section is the Verification page. Check the check-box and enter the place. You may now choose to submit the form using DSC, E-Sign or EVC. (Note: For E-Sign and EVC you must update your Aadhaar number in the Applicant Details section)

In Case of DSC:

a) Click the SUBMIT WITH DSC button.

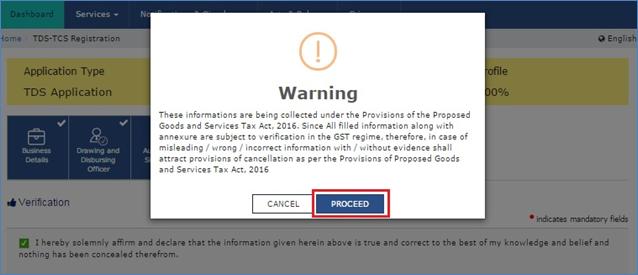

b) Click the PROCEED button.

Note:

· Make sure your DSC dongle is inserted in your laptop/ desktop.

· Make sure emSigner (from eMudra) is running on your laptop/ desktop with administrator permissions.

To check if the emSigner is running on your laptop/ desktop, perform the following

steps:

1. Click the item tray.

2. Double click the emSigner icon.

3. Click the Hide Service button to minimize the dialog box.

g) Select the certificate and click the SIGN button.

Note: To view the details of your DSC, click the View Certificate button.

You will receive the acknowledgement in next 15 minutes on your registered e-mail

address and mobile phone number. Application Reference Number (ARN) receipt is sent

on your e-mail address and mobile phone number.

You can track the status of your application using the Services > Registration >

Track Application Status command.

In Case of E-Signature:

e) Click the SUBMIT WITH E-SIGN button.

f) In the Declaration box, click the AGREE button.

Note: OTP will be sent to your e-mail address and mobile phone number registered

with Aadhaar.

g) Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail

address and mobile phone number registered with Aadhaar.

h) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15

minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

In Case of Electronic Verification Code:

a) Click the SUBMIT WITH EVC button.

b) In the Declaration box, click the AGREE button.

Note: OTP will be sent to your mobile phone number registered with Aadhaar.

c) Verify OTP screen is displayed. Enter the OTP received on your mobile phone number registered with Aadhaar.

d) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15

minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

Note: After submission, you cannot make any changes to your application.

3.1 Collaborations

|

Sr. |

Collaboration required with |

|

1. |

Domain Team |

|

2. |

Services Team |

3.2 Dependencies

|

Sr. |

Modules |

Reference/ Functionalities |

|

1 |

SRS |

|

|

2 |

SIT environment readiness for verification of content with application |

|

|

3 |

UAT completion |

|

4. Assumptions and constraints

4.1 Assumptions

|

Sr. |

Assumption |

|

1 |

Post UAT completion , the training content will be verified with the UAT environment |

4.2 Constraints

|

Sr. |

Constraint |

|

1 |

Content cannot be finalized before the UAT completion |

5. Glossary

|

SI. No |

Term / Acronym |

Description |

|

1 |

API |

Application Program Interface |

|

2 |

ARN |

Acknowledgment Reference Number |

|

3 |

B2B |

Business to Business |

|

4 |

B2C |

Business to Consumer |

|

5 |

BO |

Back Office |

|

6 |

BRN |

Branch Receipt Number |

|

7 |

CBDT |

Central Board of Direct Taxes |

|

8 |

CBEC |

Central Board of Excise & Customs |

|

9 |

CC |

Credit Card |

|

10 |

CIN |

Challan Identification Number |

|

11 |

CPIN |

Common Portal Identification Number |

|

12 |

CPIN |

Common Portal Identification Number |

|

13 |

DC |

Debit Card |

|

14 |

DSC |

Digital Signature Certificate |

|

15 |

e-FPB |

Electronic Focal Point Branch |

|

16 |

EOD |

End of the Day |

|

17 |

FC |

Facilitation Centre |

|

18 |

FO |

Front Office |

|

19 |

GDI |

Government department unique ID where department does not have GSTIN |

|

20 |

GSP |

GST Suvidha Providers |

|

21 |

GSTIN |

Goods and Services Taxpayer Identification Number |

|

22 |

GSTN |

GST Network |

|

23 |

HSN |

Harmonized System of Nomenclature for goods |

|

24 |

M |

Tax Period |

|

25 |

M+1 |

Month succeeding the tax period |

|

26 |

MCA |

Ministry of Corporate Affairs |

|

27 |

OTP |

One Time Password |

|

28 |

PAN |

Permanent Account Number |

|

29 |

POS |

Place of Supply of Goods or Services – State code to be mentioned |

|

30 |

SAC |

Service Accounting Code |

|

31 |

UIN |

Unique Identity Number for UN Bodies |

|

32 |

UIDAI |

Unique Identification Authority of India |

6. Appendices

6.1 Open items

The following table lists all the open items in this document:

|

ID |

Item |

Responsibility |

Status |

|

1 |

|

|

|

|

2 |

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

6 |

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

Table 1. Open Items

6.2 Comments Matrix

Since there is no formal tool finalized currently for logging comments on various document deliverables, Comments Matrix is being put here to ensure comments are being tracked and resolved. Once a formal tool is identified, this process might change for future deliverables.

|

S. No. |

GSTN Review Comments |

Date Raised |

Infosys Remarks |

|

1 |

|

|

|

|

2 |

|

|

|

Table 2. Comments Matrix